By Aaron Filbeck, CFA, CAIA, CIPM We have not been shy in our assessment of the current state of retirement. As we know, defined benefit plans face a tough road ahead as lofty actuarial assumptions have barely budged and regular distributions are hardly being backfilled with contributions. But what about the defined contribution crisis? Perhaps it’s not a crisis yet, but it may well be in our future as employees are forced to take on the risk of determining their own retirement destiny. At the risk of sounding like a broken record, the time has come for me to dunk on the 60/40 again. Over the past few years, there’s been an ongoing debate surrounding the viability of the 60/40 US portfolio. For decades, many “moderately aggressive” investors would have done just fine investing in this strategy and calling it a day. And why not? In hindsight, when we look back at the historical performance of a 60/40 portfolio, the returns are compelling. Even today, with cheap (or free) beta at our disposal, we can essentially buy this portfolio in one ticker! However, many savers (and advisors) tend to ignore the fact that investors who invest in asset classes are compensated by earning premiums over a risk-free rate which, worth noting, was much higher in the past. As noted in a previous blog post, since 1928, the risk-free rate (i.e., cash) has generated an average annual return of approximately 3.3%. Over the same period, U.S. equities generated an annualized return of 9.5% percent, a premium of 6.2%, while 10-year U.S. Treasuries generated a return of 4%, a premium of 1.5%. Over this entire period, a 60/40 portfolio would have generated a 7.5% return per year, excluding fees and frictions. Perhaps an outlier, those statistics have jumped dramatically over the past 10 years. Let’s use the Vanguard Balanced Index Fund (the US 60/40 portfolio linked above) as an example to get an understanding of an actual investor experience. As of Sept. 30, 2020, the 10-year rolling return is 9.58%! But that’s all in the past, and it’s rarely a good idea to extrapolate short historical time periods into the future. Still, if we assume these historical risk premium assumptions remain constant, the math to achieve the absolute returns of the past looks very difficult. With the risk-free rate effectively 0%, a policy portfolio of 60% U.S. stocks and 40% 10-Year U.S. Treasury bonds should generate a return of 4.9% per year, a 2.5% drop from history…even without adjustments for current valuations. This is important data for individual investors and financial advisors who may be tempted to model future absolute returns using historical information. Financial plans, and subsequent behavior, will likely need to be adjusted. While multiple solutions exist to bridge the gap, I’ve highlighted four of the most realistic below: Saving More Money: While none of us as individuals have control over markets, we can certainly control our spending and saving habits. It may be a painful reality, but retirement savers (who already maintain low balances relative to their needs[i]) may need to significantly bump up their retirement savings rate, relying less on returns to achieve their retirement objectives. This isn’t necessarily bad news for young clients who are saving early, but for late starters this could be a significant adjustment. Fidelity currently recommends individuals save 15% (employee + employer) of their salary for those who started saving at age 25.[ii] That recommendation jumps, however, the further one delays saving for retirement. The role an employer, a plan sponsor, or advisor can play in educating employees early is so valuable. After all, you can’t manage a portfolio if there’s nothing in it. Work Longer and Take Less: In addition to spending or saving habits, we can also control when we actually retire. Delaying retirement, allowing a few extra years of saving, and continuing to grow the portfolio can potentially add a few extra years to the retirement plan. Additionally, the retirement income rule of thumb is the “4% rule,” meaning investors should plan to take out approximately 4% of their portfolio per year. In other words, if you require $40,000 per year in retirement, you should probably plan to have a $1,000,000 portfolio. Perhaps that rule worked when bond yields were 5%+ but, with high quality bonds now sub-1%, individuals may need to become more conservative with their retirement income expectations. Making the Shifts: We can also control how we respond to market movements. In many cases, the best course of action is to do nothing, but simple acts such as regular rebalancing, tax-loss harvesting (where applicable), and maintaining low expenses within investment vehicles can add incremental, long-term value to the overall portfolio. While asset allocation is often a driving force for returns, especially for individual investors, there may be some opportunities for diversification and/or incremental returns by incorporating dynamic strategies that provide appropriate factor exposures or alpha generation. For those with the resources, hiring active managers with proven track records may also be able to add incremental value, but caution should be taken here, as the majority of U.S. active long-only managers underperform their respective indexes.[iii] Therefore, one should seek active management in areas where (1) the manager has an edge over their peers and (2) the manager researcher has an edge in selecting the right manager. Adjusting the Allocation: Unfortunately, in the current state of product offerings, many clients may simply be forced to take on additional risk within their strategic asset allocation. That might be as simple as the infamous 60/40 turning into a 70/30 or 80/20, in an effort to take on more equity beta due to the low starting yield of government bonds.  However, a shift like this does not get the portfolio return to the returns of the past, and it forces the investor to take on more volatility. So, short of leverage, what else has to happen to bridge the gap? We know capital formation has continued to move towards the private markets. Currently, these markets aren’t open to the individual investor, for many good reasons, but the options available are shrinking (see Figure 1). However, if we are going to thrust the liability of retirement destiny onto the individual, shouldn’t we find a way to give that individual the assets to get there? It’s not that simple, of course, but we’ve barely begun to make an effort. If we are going to force more beta into portfolios, perhaps we should offer more than one. To combat volatility, retirement savers need additional tools at their disposal. Out of necessity, retirement savers will likely use a combination of all of these options and more. Whether or not equity markets are over-, under-, or fairly valued, risk-free rates are still at 0%. The hurdle to achieve the returns of history is much higher with that type of starting point. Balancing risk and return have gone beyond the asset allocation decisions that got us here, as it has now infiltrated the balance sheet of the retirement saver. Individuals are left to fend for themselves as the defined benefit plan is becoming less popular and the defined contribution plan takes its place. Yes, we need to rethink asset allocation and diversification, out of necessity, but we will also need to rethink how we approach personal finance, coaching, and literacy as well. Seek education, diversification of both your portfolio and people, and know your risk tolerance. Investing is for the long term. Aaron Filbeck, CFA, CAIA, CIPM is Associate Director of Content Development at CAIA Association. You can follow him on LinkedIn and Twitter. [i] The average 401(k) balance by age, income level, gender, and industry [ii] How much should I save for retirement? [iii] https://www.spindices.com/spiva/#/reports

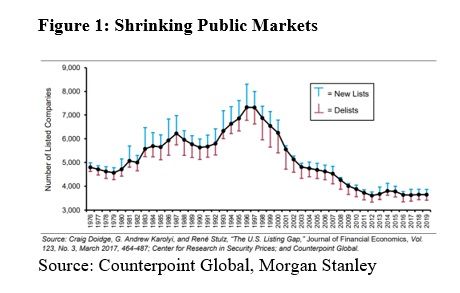

However, a shift like this does not get the portfolio return to the returns of the past, and it forces the investor to take on more volatility. So, short of leverage, what else has to happen to bridge the gap? We know capital formation has continued to move towards the private markets. Currently, these markets aren’t open to the individual investor, for many good reasons, but the options available are shrinking (see Figure 1). However, if we are going to thrust the liability of retirement destiny onto the individual, shouldn’t we find a way to give that individual the assets to get there? It’s not that simple, of course, but we’ve barely begun to make an effort. If we are going to force more beta into portfolios, perhaps we should offer more than one. To combat volatility, retirement savers need additional tools at their disposal. Out of necessity, retirement savers will likely use a combination of all of these options and more. Whether or not equity markets are over-, under-, or fairly valued, risk-free rates are still at 0%. The hurdle to achieve the returns of history is much higher with that type of starting point. Balancing risk and return have gone beyond the asset allocation decisions that got us here, as it has now infiltrated the balance sheet of the retirement saver. Individuals are left to fend for themselves as the defined benefit plan is becoming less popular and the defined contribution plan takes its place. Yes, we need to rethink asset allocation and diversification, out of necessity, but we will also need to rethink how we approach personal finance, coaching, and literacy as well. Seek education, diversification of both your portfolio and people, and know your risk tolerance. Investing is for the long term. Aaron Filbeck, CFA, CAIA, CIPM is Associate Director of Content Development at CAIA Association. You can follow him on LinkedIn and Twitter. [i] The average 401(k) balance by age, income level, gender, and industry [ii] How much should I save for retirement? [iii] https://www.spindices.com/spiva/#/reports

- Programs

- Events and Webcasts

- Resources

- About

- Official Merchandise

Search

Search Close

Close