By Fiona Boal, Head of Commodities & Real Assets, and Jim Wiederhold, Associate Director, Commodities & Real Assets, S&P Dow Jones Indices

Commodities may be the building blocks of the real economy, but they have long been viewed as the poor cousin in the investment universe, and often for good reason. Unlike equities, commodities do not offer a so-called market beta that drifts higher over time in line with economic activity. In contrast, they present a collection of unique price returns that reflect the underlying supply and demand dynamics of physical assets.

Commodities as An Asset Class

Even though individual commodities share important characteristics, commodities are not homogeneous. Low intra-commodity correlation is one of the few common threads between individual commodity markets, though there are important exceptions among commodities that form part of the same production process or may be substitutes. There is little market “beta” when it comes to corn, copper, crude oil, and coffee.

Another idiosyncrasy with commodities is that, by definition, it is difficult and costly for most market participants to buy, sell, and store physical commodities as an investment. For example, it would be rather tricky and very expensive for an asset manager to buy and sell truckloads of live cattle or barrels of oil.

Commodities are not anticipatory assets; they reflect current, real-world, “spot supply and demand” conditions. They also do not provide an income stream, which makes them more difficult to value than assets from equity and fixed income markets.

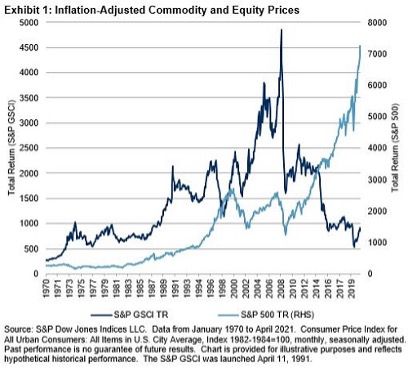

Commodity prices do not track a long-term upward trajectory. Over a nearly 50-year period from 1970 to early 2021, commodity prices rose only modestly, albeit interspersed with periods of significant and often violent price spikes.

Traditional Uses of Commodities – Inflation Protection and Diversification

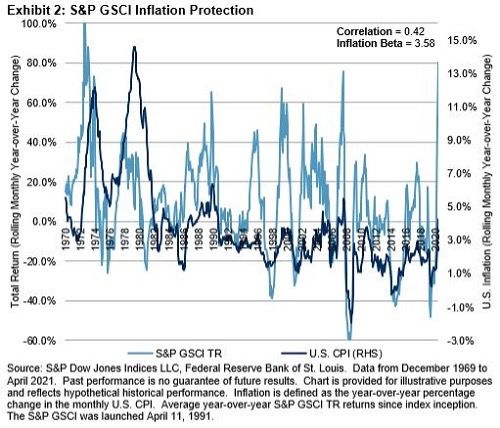

One of the most common justifications for a long-biased exposure to commodities in a diversified portfolio is that commodities have historically proven to be a reliable hedge against inflation. They are often touted as being particularly effective when it comes to unexpected inflation. This makes intuitive sense because it is often a commodity supply shock that causes unexpected inflation. Even though the trajectory of real asset inflation is likely lower today than it was in the past, due to structural changes in demographics, technology, consumption, and productivity, starting from today’s low inflation level means even a small increase in inflationary pressure could lead to notable asset repricing and an important role for commodities in an investor’s armoury.

In Exhibit 2, we compare the historical monthly year-over-year percentage changes in inflation against the S&P GSCI and calculate an inflation beta measure for commodities. Inflation beta is a measure of the responsiveness of an asset’s returns to observed changes in inflation.

For many market participants, unprecedented and coordinated fiscal stimulus in the wake of the COVID-19 pandemic has justified current concerns over inflation. As the last period of prolonged inflation occurred decades ago, most investors have not experienced it. It may be difficult for them to assign a probability to a sustained period of inflation, as well as to adapt portfolio construction should the probability be sufficiently high. Investors tend to have short memories.

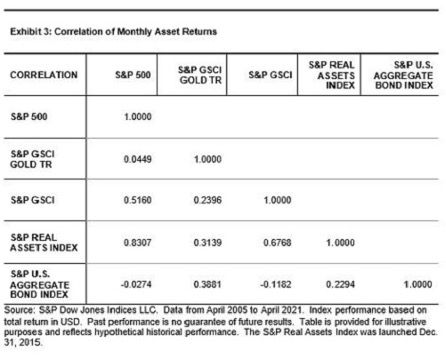

Diversification is often considered the only “free lunch” in investing. Combining low or negatively correlated asset classes in a portfolio has the potential to lower overall portfolio volatility without sacrificing returns (or to even improve risk-adjusted returns). Commodities tend to have low correlations to traditional asset classes, and they can potentially offer investors valuable diversification benefits (see Exhibit 3).

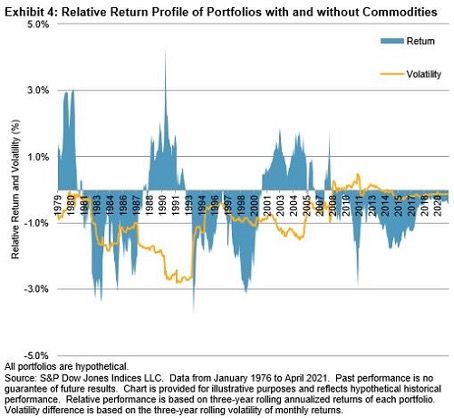

It is important to take a long-term perspective of commodity performance. Exhibit 4 compares the relative rolling three-year performance of a 55% equity/40% bond/5% commodity portfolio to a typical 60% equity/40% bond portfolio. The relative performance of the portfolio containing commodities has varied over time. Since the 2008 Global Financial Crisis, a portfolio with a small allocation to commodities has underperformed while, on average, offering slightly lower volatility. From a risk-adjusted return perspective, the lower volatility has not been sufficient to compensate for the lower returns. Since the beginning of 2019, including during the height of the COVID-19 pandemic, the relative underperformance of the portfolio including commodities has been particularly small, raising the question of whether asset class correlations have become structurally stronger.

No one has a crystal ball, but long-term history suggests that there can still be some potential diversification benefits from adding commodities to a multi-asset portfolio. As far as inflation is concerned, to the extent that inflation surprises to the upside, a commodity allocation may still offer protection.

This blog is based on the paper, Rethinking Commodities, published January 2020. The posts on this blog are opinions, not advice. Please read our Disclaimers.

For additional SPDJI commodities research & insights visit https://www.spglobal.com/spdji/en/landing/investment-themes/commodities/.