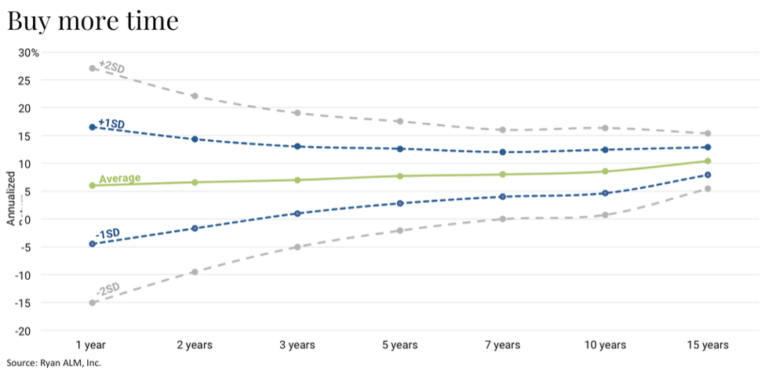

By Russell Kamp, Managing Director at Ryan ALM There is a lot of volatility in a normal asset allocation in short time frames. We’ve seen this unfold dramatically in a number of cases during the last couple of decades. To reduce this volatility, I often guide our pension clients to adopt a cash-flow-driven investment (CDI) approach.  As the graph above reflects, a representative asset allocation (5% cash, 5% international equities, 55% domestic equities, and 35% bonds) has produced an average one-year return of 6.03% for the last 20 years (monthly moving average) with a standard deviation of 10.5%. Within two standard deviations (95% of observed values) that average 6% return could range from +27% to -14%. You can drive a couple of semis through that gaping hole! I suspect that no plan sponsor would ever tolerate hearing their consultant remark, “Your fund was down 12.5% during the last 12-months, but don’t worry, as it isn’t statistically significant.” The primary goal should be to get plan sponsors securing the promised benefits net of contributions for the next 10 years. Each plan sponsor will be different, so they might consider using their current bond and cash allocation to accomplish this objective, which will significantly reduce the volatility inherent in this traditional asset allocation.

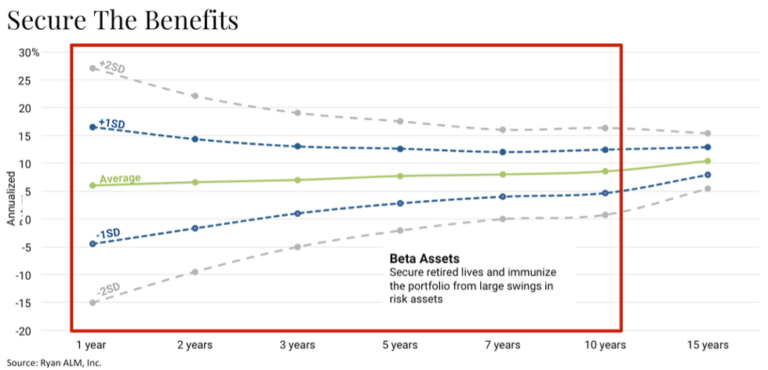

As the graph above reflects, a representative asset allocation (5% cash, 5% international equities, 55% domestic equities, and 35% bonds) has produced an average one-year return of 6.03% for the last 20 years (monthly moving average) with a standard deviation of 10.5%. Within two standard deviations (95% of observed values) that average 6% return could range from +27% to -14%. You can drive a couple of semis through that gaping hole! I suspect that no plan sponsor would ever tolerate hearing their consultant remark, “Your fund was down 12.5% during the last 12-months, but don’t worry, as it isn’t statistically significant.” The primary goal should be to get plan sponsors securing the promised benefits net of contributions for the next 10 years. Each plan sponsor will be different, so they might consider using their current bond and cash allocation to accomplish this objective, which will significantly reduce the volatility inherent in this traditional asset allocation.  As the chart above highlights, by separating the assets into two buckets – beta (the red box above) and alpha (the green box below)—we can secure the promised benefits through a CDI implementation that extends the investing horizon for the alpha assets that now have time to grow unencumbered. In a traditional asset allocation, all assets are on hand to fund benefits net of contributions. During periods of market turmoil, liquidity may not be as abundant as usual and often assets are sold at less than ideal times. This forced selling exacerbates the underperformance experienced by the fund. As you also see by the graph above, extending the investing horizon has substantially lessened the volatility through time. Where a one-year period had a standard deviation of 10.5%, the standard deviation for average annualized returns across a 10-year period is only 3.9%, which significantly enhances the probability of success for the plan. In the asset allocation example, the average 10-year return during the last 20 years was 8.55%. Thus, observation of the results with two standard deviations would be between 0.75% and 15.35%, which is far more tolerable than living with the volatility of a one-year horizon.

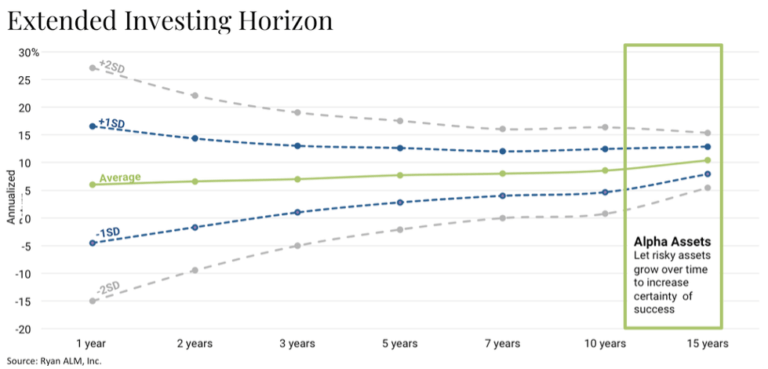

As the chart above highlights, by separating the assets into two buckets – beta (the red box above) and alpha (the green box below)—we can secure the promised benefits through a CDI implementation that extends the investing horizon for the alpha assets that now have time to grow unencumbered. In a traditional asset allocation, all assets are on hand to fund benefits net of contributions. During periods of market turmoil, liquidity may not be as abundant as usual and often assets are sold at less than ideal times. This forced selling exacerbates the underperformance experienced by the fund. As you also see by the graph above, extending the investing horizon has substantially lessened the volatility through time. Where a one-year period had a standard deviation of 10.5%, the standard deviation for average annualized returns across a 10-year period is only 3.9%, which significantly enhances the probability of success for the plan. In the asset allocation example, the average 10-year return during the last 20 years was 8.55%. Thus, observation of the results with two standard deviations would be between 0.75% and 15.35%, which is far more tolerable than living with the volatility of a one-year horizon.  The alpha assets (highlighted by the green box) that presumably have a liquidity premium associated with them now have the time necessary to grow unencumbered. Furthermore, the alpha bucket can invest in all sorts of assets other than traditional fixed income assets that are too highly correlated to plan liabilities. This process should result in much more stable contribution expenses and funded ratios. As the plan moves through time, it is highly recommended that the sponsor and their consultant contribute the necessary amount to keep the beta bucket defeasing the next 10-years of plan liabilities. As we move through this incredible period for markets, many participants are naturally worried that their promised benefits may be at risk. For those plans that have adopted a CDI approach, sponsors can safely tell their participants not to worry as their promised benefits are secured for the next 10-years. Furthermore, plans don’t have to worry about raising liquidity to meet those net benefit payments, as the cash flow from the CDI portfolio will be there every month to meet the next month’s payments. Don’t you think that your participants want to hear such a message?

The alpha assets (highlighted by the green box) that presumably have a liquidity premium associated with them now have the time necessary to grow unencumbered. Furthermore, the alpha bucket can invest in all sorts of assets other than traditional fixed income assets that are too highly correlated to plan liabilities. This process should result in much more stable contribution expenses and funded ratios. As the plan moves through time, it is highly recommended that the sponsor and their consultant contribute the necessary amount to keep the beta bucket defeasing the next 10-years of plan liabilities. As we move through this incredible period for markets, many participants are naturally worried that their promised benefits may be at risk. For those plans that have adopted a CDI approach, sponsors can safely tell their participants not to worry as their promised benefits are secured for the next 10-years. Furthermore, plans don’t have to worry about raising liquidity to meet those net benefit payments, as the cash flow from the CDI portfolio will be there every month to meet the next month’s payments. Don’t you think that your participants want to hear such a message?

- Programs

- Events and Webcasts

- Resources

- About

- Official Merchandise

Search

Search Close

Close