By Nicolas Rabener, CAIA, of FactorResearch (@FactorResearch)

The insurance policy is one of the game-changing products of our civilization as the individual is protected against great financial harm by the rest of society. Everyone understands the concept and accepts paying premiums to insure their house, their car, or their health. There seem few limitations to what can be insured. For example, Lloyd's of London has apparently sold more than 20,000 policies against alien abductions.

Investors are constantly concerned about hedging their portfolios, but the willingness to buy insurance seems lower than for their home or car. Most aim to insure their portfolios via diversification but expect the diversifying strategy to also make money. Bonds have worked wonderfully for achieving this objective in recent decades, while most hedge funds have failed to provide such uncorrelated and positive returns.

Long volatility strategies represent one of the closest approximations to an insurance policy for an equity portfolio as volatility usually spikes when stock markets crash. However, like insurance, the strategy tends to lose money consistently across years before a payoff occurs.

Furthermore, long volatility strategies are often created via complex option portfolios, which are difficult to understand and make investors wary. If these strategies could be created with simpler instruments, then perhaps this would increase investors’ interest in them.

In the research note, we will explore building a systematic long volatility strategy without using options.

LONG VOLATILITY INSTRUMENTS

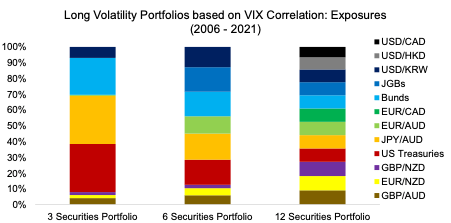

There are many approaches to creating a systematic long volatility strategy. We are using a simple approach that measures the correlation of various asset class indices when then VIX spiked significantly between 2006 and 2021, which results in a sample of 13 observation periods. The set of 59 indices essentially represents all available asset classes—equities, bonds, commodities, and currencies.

Each index is ranked on its correlation to the VIX during each of the observation periods. Based on this, a rolling rank is calculated for each index that represents the average sensitivity to the VIX. The ranks are only used going forward to avoid hindsight bias. The higher the rank, the more suitable the index is assumed to be for a long volatility portfolio. Finally, we create three long volatility portfolios by selecting the 5%, 10%, and 20% most highly ranked indices, which implies holdings of 3, 6, or 12 indices.

We observe that these portfolios were comprised exclusively of bonds and currencies in the period between 2006 and 2021. There was zero exposure to commodities like gold, and naturally none to equities. The top three indices that generated the strongest returns when the VIX spiked were German Bunds, JPY / AUD, and US Treasuries. All of these are known as risk-off instruments, so this is somewhat expected.

Source: FactorResearch

PERFORMANCE OF SYSTEMATIC LONG VOLATILITY STRATEGIES

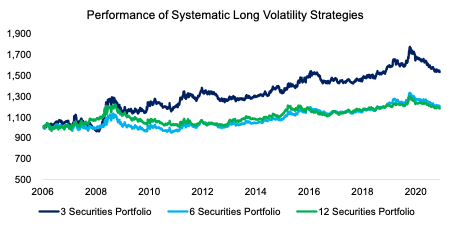

Next, we analyze the performance of the three long volatility portfolios. We observe that all three exhibited the same trends in performance, e.g. a significant spike during the Global Financial Crisis in 2008 and COVID-19 in March 2020, but the returns over that 15-year period were dramatically different.

The most concentrated portfolio comprised of three securities generated strongly positive returns, which can be partially attributed to the exposure to government bonds that had strong performance. The other two portfolios had almost the same return, which is explained by many of the positions representing the same trade, e.g. GBP / AUD and EUR / AUD.

Source: FactorResearch

CORRELATION OF LONG VOLATILITY STRATEGIES TO THE S&P 500

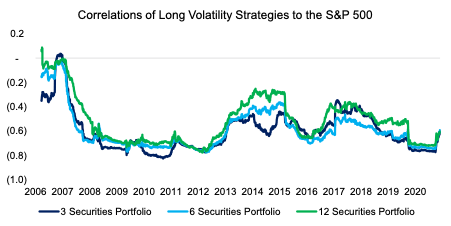

However, although generating positive returns is desirable, we should recall that insurance has a cost. Investors’ rational expectation of a long volatility strategy should be that it provides positive returns when volatility is rising, but not necessarily on average.

We calculate the correlation of the three long volatility strategies to the S&P 500, which highlights a negative correlation on average. It is worth mentioning that returns should not be too negatively correlated to equity returns as then the strategy detracts too much performance of the combined portfolio. The ideal would be a mildly negative correlation to stocks.

Source: FactorResearch

REDUCING DRAWDOWNS WITH LONG VOLATILITY STRATEGIES

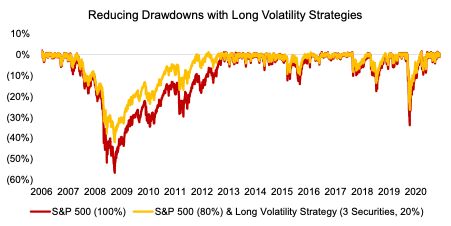

Given the negative correlation, the long volatility strategies should generate attractive diversification benefits for an equity portfolio. We simulate this by comparing the drawdowns of the S&P 500 with a portfolio that includes a 20% allocation to the long volatility portfolio comprised of three securities.

As expected, we observe that the drawdowns were significantly reduced by allocating to the long volatility portfolio, especially during the Global Financial Crisis.

Source: FactorResearch

DIVERSIFICATION BENEFITS FROM LONG VOLATILITY ALLOCATIONS

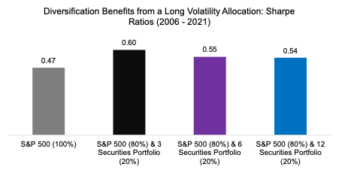

Finally, we analyze the impact on returns when allocating 20% to the three long volatility strategies. The annualized return in the period from 2006 to 2021 decreased from 8.6% for an all-equity portfolio to 7.9%, 7.4%, and 7.4%, respectively. Given that long volatility strategies represent insurance policies for equity portfolios, this is to be expected.

However, the risk-adjusted returns increased regardless of which long volatility portfolio is used, which demonstrates the diversification benefits.

Source: FactorResearch

FURTHER THOUGHTS

This analysis highlights a simple approach for building a systematic long volatility strategy using various asset classes that can all be traded efficiently via futures. Given this, the strategy has a much larger capacity for assets under management than the option-based alternatives as these are typically liquidity-constrained. However, such a systematic strategy is also unlikely to offer the strong payoff characteristics that can only be achieved by using options, unless significant leverage is used.

An alternative approach for building a systematic long volatility strategy is attempting to replicate the Eurekahedge Long Volatility Hedge Fund Index, which comprises managers focused on this space. Most hedge fund strategies can be replicated systematically, so this an interesting research area.

However, even if we can create a robust long volatility strategy using simple instruments like bonds or currencies, it is unlikely ever to become as popular with investors as property or car insurance. Some investors are fine with paying premiums, but for most, the notion of investing in a strategy that can lose money consistently for years represents pure anathema.