By Peter Gaffney - Head of Research at Security Token Advisors.

Impressive Institutional Entrances

A brief list of legacy names that threw their hats in the tokenization ringer or expanded their current footprints in some way, shape, or form throughout Q3 2023:

- London Stock Exchange Group (LSEG) - announced blockchain-powered exchange for simple cross-border, cross-jurisdiction securities transactions (source)

- JP Morgan - unveiled its Tokenized Collateral Network (TCN) through money market swaps between BlackRock and Barclays (source)

- Citi - offering Citi Token Services to institutional clients and trade finance partners; signs on as digital custodian distributing BondbloX digital bonds to the firm’s Singapore private bank clients (CTS, BondbloX)

- UBS - tokenized a variable capital company (VCC) money market fund within Singapore’s Project Guardian (source)

- Goldman Sachs - iterating with the Hong Kong Monetary Authority (HKMA) to improve custodial connectivity for its GS DAP digital bond issuance (source)

- WisdomTree Inc - launched its WisdomTree Prime app for digital 1940 Act Funds in 30+ states (source)

- Depository Trust & Clearing Corporation (DTCC) - fully acquires Securrency for widespread blockchain-based transaction capabilities (source)

Blockchain-based Payments for the Banking World

Perhaps the largest value-driver for tokenization on the institutional side is purely in the payments and collateral mobility realm. Largely escalated by JP Morgan Onyx Digital Assets and its blockchain-based repo and Tokenized Collateral Network (TCN) initiatives, JPM Coin is just under $1 trillion in volume over the past couple of years. It proved the concept and execution of tokenized bank deposits and makes use of its client and partner capital for mobility and swaps within the blockchain division. Rather than playing around with outdated technology and timelines, Onyx began tokenizing deposits to then have a 24/7 real-time payment method for its blockchain initiatives centered around high-volume and round-the-clock transactions.

Onyx Digital Assets reached the $900 billion in transactional volume mark in October 2023, now clocking up to $2 billion in daily transaction volume. The firm’s traditional payments flow reaches $10 trillion daily, so there is quite some room to run especially as the Onyx team estimated $20 million in annual savings to the repo markets through tokenization. The value proposition here is the precision associated with the blockchain ledger. Parties can program properly delivery v. payment conditions into these repurchase agreements for accurate execution rather than going back and forth negotiating how long a transaction actually took and the associated interest fees. While much of this has been focused on cash via customer deposits getting transfigured into JPM Coin, the same process can be applied to money markets, treasuries, equities, and eventually alternatives - and that is the beautiful part.

On that note, JP Morgan officially launched its Tokenized Collateral network (TCN) with BlackRock and Barclays after a number of test transactions and developments. TCN is designed to move collateral seamlessly and instantaneously among buy-side and sell-side parties. Previously testing the network with tokenized deposits and internal transactions, the investment bank made use of BlackRock money market shares in which the asset manager noted, “collateral in clearing and margining transactions would dramatically reduce the operational friction in meeting margin calls.” These tokenized shares specifically were held with Barclays as collateral in an OTC derivatives trade.

TCN is expanding what the industry thought of ‘tokenization’ as. This is a serious and tangible use-case of tokenization that will have positive externalities on numerous trading functions and asset classes (margin, derivatives, OTC swaps, treasury management are just a few components named in this press release alone). The interesting part is that the actual tokenization of the money market shares took a few minutes due to connectivity between BlackRock’s Transfer Agent (which is Computershare) and TCN. Computershare is one of the industry’s largest legacy TA’s, making this both a promising precedent for Computershare customers and for the feasibility of tokenization, meaning it wasn’t the case that some firm bought BlackRock money market shares held in an SPV and issued tokens on that SPV, but rather, these are true, existing money market shares that became actionable in the Tokenized Collateral Network in real-time. From there, share transfer between BlackRock and Barclays was instantaneous, proving out the feasibility of on-chain intraday collateral.

Similarly, Citi launched its Citi Token Services (CTS) as the closest competitor to JPM’s Onyx Digital Assets solutions. Citi was already active with proof-of-concept trade finance cases in India, but formally rolled out trade finance solutions under the CTS umbrella in September 2023. The blue-chip bank is working with Maersk on smart contract governed shipping and trade finance contracts. These contracts execute via tokenized deposits, which is the other focus within CTS that’s more similar to the aforementioned JPM Coin. Citi is looking to tokenize its high-net-worth client assets to make use of them more actively and favorably for its clientele, as newer yield opportunities and total return makeups get passed through to said clients. Notably, Citi signed on as digital assets custodian to BondbloX, a Singapore-based and regulated fractional corporate credit platform, to seamlessly connect and distribute these tokenized bonds to its private banking and qualified clientele; this is another strong precursor to tokenized product distribution that the rest of the industry can’t seem to crack.

The Blockchain Savings: Basis Points to Human Capital

The greatest efficiencies will come through end-to-end digital systems - meaning an on-chain lifecycle - in the form of tangible dollar savings or manual labor time relative to traditional process counterparts. Platforms are taking steps towards this reality in addressable market sizes in the billions and trillions of dollars ranges. A snapshot of savings through trials are as follows:

- Goldman Sachs Digital Asset Platform (GS DAP) achieved 15 basis points in savings for its €100M digital bond issuance, resulting in €150K of added return passed onto Union Investment as the sole buyer.

- J.P. Morgan’s Onyx Digital Assets (ODA) is projecting $20 million in savings on an expected $1 trillion in tokenized repo volume by the end of 2023.

- Broadridge’s Distributed Ledger Repo (DLR) is saving sell-side clients like Societe Generale $1 million per 100,000 repo transactions.

- Equilend launched 1Source as a distributed ledger-based securities lending solution to save the securities lending industry an estimated $100 million in collective costs.

- Structured finance servicing platform Intain reports 100 basis points in savings by reducing SME loan lifecycle fees from 150 bps to 50 bps through Hyperledger and Avalanche blockchain solutions.

- Vanguard is leveraging R3’s Corda through Grow Inc. to achieve straight-through processing saving 100 hours a week in labor.

- Liquid Mortgage has reduced Mortgage-Backed Securities (MBS) reporting from 55 days to 30 minutes on the Stellar blockchain.

These savings range with the levels of digitization and tokenization. The greatest savings will be seen at the endpoint in which fully-native digital systems exist, meaning assets originated on-chain and live only there. They aren’t digital twins of off-chain funds, products, or assets, but rather act as the only entry point. A useful example of this is what Figure is looking to solve with its Provenance Blockchain-based HELOCs and mortgage securities. Leaders like Guaranteed Rate and Movement Mortgage originate these HELOCs on-chain so that the end user is in a digital interface. Eventually, they’ll be tradable on Figure ATS or other digitally-native compatible Alternative Trading Systems (ATS) and venues; the ability to collateralize these in compliant DeFi services is also a great consideration.

Low-to-moderate savings on the spectrum will be found in digitally-enhanced products, which may represent existing off-chain funds or assets in a security token wrapper. The lower savings here stems from the fact that traditional documentation and processes still hinder the digital product, to an extent. A token that must revert to its monthly PDF or Excel reporting calculations, for example, will always be at mercy of that process still driven by labor, making it susceptible to errors, delays across parties, mis-reconciliation, and other common hurdles. Digitally native is the future, but it takes time to reach that point. Baby steps are mostly positive as infrastructure builds out and bridges the gaps shown between legacy and digital systems.

Chainlink Dominates the Intersection of Off-chain and On-chain Value Flow

Of all of the public blockchains and solutions offered, Chainlink has has perhaps the most impressive run in Q3 2023 with regards to tokenization infrastructure. Chainlink is designed to provide an interoperable future among varying public (and private) blockchains. The end goal is to enable applications, products, and most importantly, users and investors, to interact with one frontend while gaining access to the entire blockchain universe on the backend. This backend may consist of assets on Polygon, Avalanche, Ethereum, Algorand, Base, and more; what makes them seamless is the solution that Chainlink brought to market through the Chainlink Cross-Chain Interoperability Protocol (CCIP).

Through CCIP, Chainlink can take orders from users, lock and execute value transfers across chains, and ultimately bridge applications from chain to chain. As issuers like Franklin Templeton and WisdomTree continue to offer their fund products on multiple blockchains, it’s imperative that value flow is seamless; otherwise, the blockchain world will be hindered much like converting fiat dollars to other currencies. CCIP offers a solution for these blockchains to actually communicate with each other even to the point of properly locking capital that shouldn’t move when in waiting. For example, an Avalanche-based asset worth $1,000 might be locked by CCIP when that user elects to swap that value over to an Ethereum-based application. The value is then transferable within the Ethereum ecosystem and only unlocks in Avalanche when sent back to the AVAX ecosystem. Products and transactions continue to get more complex, and tokenization will enable other unique structured products and trading strategies. CCIP and similar solutions are necessities to navigating that reality.

Some of the other work Chainlink’s done to engrain itself in the institutional capital markets can be seen through Swift and the Depository Trust & Clearing Corporation (DTCC). “For tokenization to reach its potential, institutions will need to be able to seamlessly connect with the whole financial ecosystem.” That’s directly from Swift’s Chief Innovation Officer in context of the financial messaging organization's trials with Chainlink and a dozen+ financial institutions. The main goal of this June 2023 trial was to determine the feasibility of implementing Chainlink and its services to enable cross-platform communication with Swift acting as the central entry point.

Recent findings from August 2023 are quite positive. Specifically making use of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Swift was successful in transferring tokenized value across both private and public blockchains alike with participating parties like BNP Paribas, BNY Mellon, Lloyds Bank, the DTCC, and Citibank. CCIP launched in July with support for Avalanche, Ethereum, Optimism, and Polygon - which covers the public blockchain tokenization side pretty well - and likely added support for private networks such as Corda, Daml and Canton, and Hyperledger.

Swift’s goal here is to accelerate the adoption and value-add usage of tokenization by leveraging its existing monumental positioning within the financial markets. Swift is the go-to for financial island interbank messaging; this is also one of the clearcut targets for tokenization regarding asset mobility. Swift’s successful demonstration here, and ideally more to come, will act as a highway for widespread tokenization efforts across its 11,000 members and users, rather than the backroads that the vast majority of one-off tokenization cases are driving on.

The $670 billion Australia and New Zealand Banking Group (ANZ) also became a fan of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to facilitate the swapping of ANZ-issued stablecoins for nature-based assets. Specifically, “Similar to how interoperability standards transformed the Internet and global banking, a cross-chain interoperability standard could accelerate the adoption of tokenized assets amongst financial institutions.” Interestingly, ANZ was able to offer multiple private bank chains, connect those chains via CCIP, and even permission certain “DeFi” activities across public chains within groups. All in all, CCIP is proving itself out as a widespread, public and private interoperability service that’s now bridging the gap between banking and regulated DeFi.

Treasuries and Money Markets Galore

On the marketable product side, outside of asset-backed securities through Figure and Provenance Blockchain, none have been more tangible this past quarter than the cohort consisting of tokenized treasury funds, money market funds, and similar professionally-managed yield products. Not tokenized real estate. Not private equity or private credit funds. Not even digital bonds, which had the strongest momentum in early 2023.

A big theme of the State of Security Tokens 2023 - Q2 report was the concept of stablecoin substitutes. The reality is that financial institutions and asset managers probably won’t park a few hundred million dollars of their client assets into a stablecoin generating zero yield. This reality is magnified when considering the risk-free rate was 4.73% to end the quarter. Tokenization doesn’t make a product magical, and the same fundamental investing mechanics will apply to the digital capital markets as they do in existing capital markets. With a Treasury Bill rate this high, investors and money managers are milking that yield for all it’s worth.

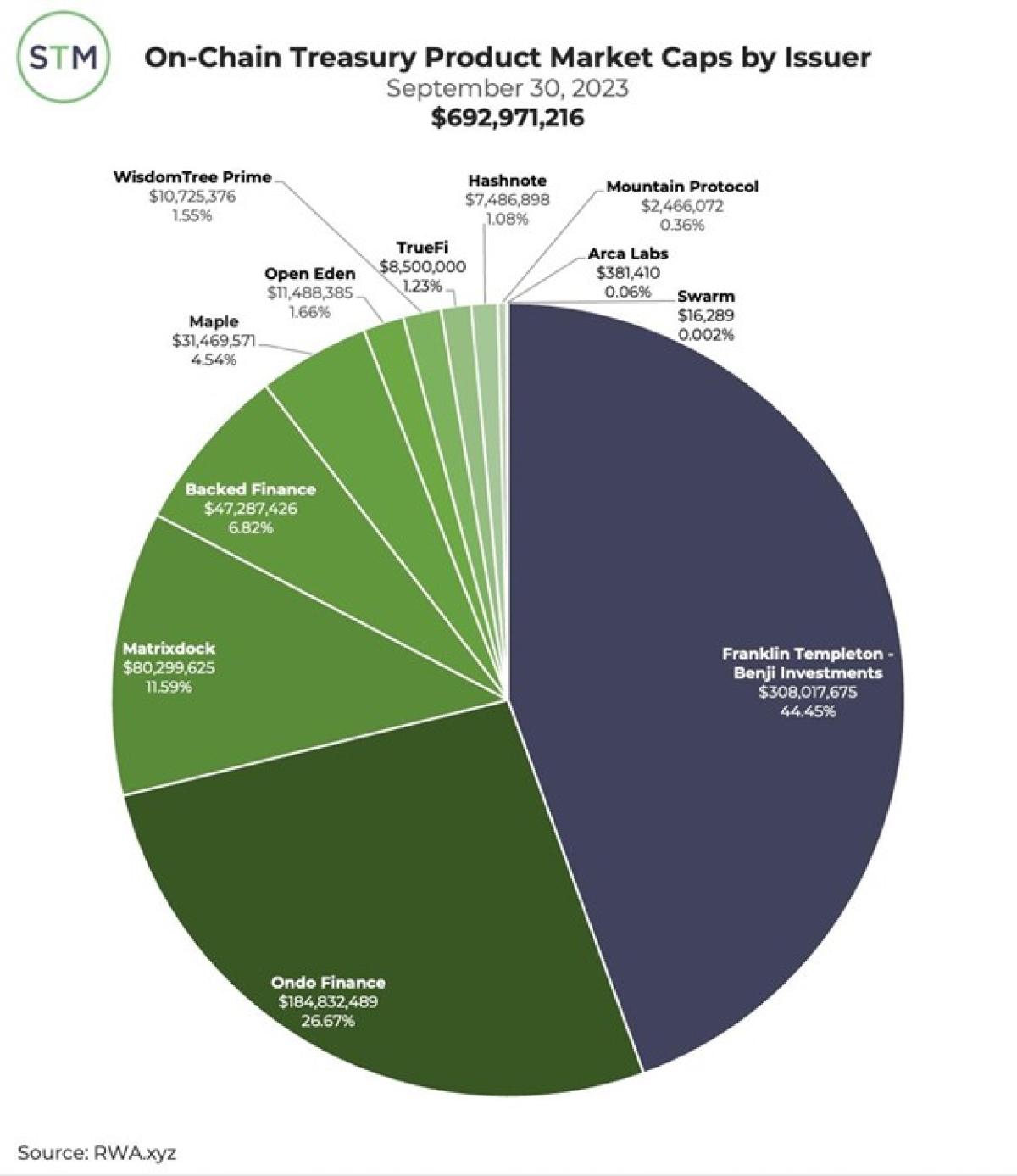

The cohort of on-chain money market funds, treasury funds, and treasury products grew to over $692 million during Q3, up 508% on the year and almost 20% on the quarter. Some of the largest and more notable issuers of on-chain treasuries and money markets include Franklin Templeton, Ondo Finance, Matrixdock, Backed, and WisdomTree according RWA.xyz.

A common misconception and question that’s thrown around is why anybody would even hold treasuries, treasury funds, or money market funds as a digital token when those markets are already so efficient - some of the most efficient relative to every other product line. That’s a surface level way of viewing the technology and the industry. The answer comes back to the aforementioned point about stablecoin substitutes.

Why would any money manager or investor choose to hold a tokenized money market fund? Well, if they are preparing for an investment in other tokenized products or onboarding to make use of the surrounding compliant, permissioned decentralized finance (DeFi) ecosystem, they’ll need an entry point. The options are either stablecoins or compatible digital cash, which could take the form of tokenized deposits, tokenized money market funds, tokenized treasury funds, or other high quality liquid assets on the digital rails.

It’s important to understand that for a fully end-to-end digital solution to become implemented - whether that’s on a product issuance side, a collateral mobility initiative, or to streamline lending and borrowing opportunities - there must exist a digital settlement token. Something like investing in a digital private equity fund that requires capital calls is a nice example. Capital should be held on-chain for both the issuer and investor to verify, as that’s one of the promised perks of digital funds. While that capital sits there, what happens? Well, if that on-chain mechanism is a stablecoin or a generic digital dollar, then it’ll just sit there for however long until that capital call is initiated. It could be 30 days or 3 months, and those digital dollars will have likely generated nothing in yield. Contrast that with a tokenized money market or treasury product generating around 5% annually, and that’s a material difference. As a fiduciary, there’s little to no excuse not to consider the on-chain risk-free yield product in that situation. So long as the investment product (PE fund) and the settlement product (money market / treasury) are built on compatible digital rails (i.e the same blockchain or compatible chains and solutions), the digital loop closes and investors are maximizing their return potentials.

What’s also interesting now is the differentiation in products. Although it is incredibly early and we haven't even reached a billion dollars in collective assets across this cohort, the industry is seeing providers of both funds and individuals when on the treasury side; that is, tokenized treasury funds and tokenized treasury bills themselves. Much like in the existing capital markets, product issuers are always competing on basis points. Whether that’s excess basis points to add to their own earnings or basis point reduction in fees relative to their direct competitors, it matters. Similarly, there does exist cash drag and layered fees on tokenized treasury and money market funds that may not exist or may be mitigated through individual treasury bills. While many of the current issuers - and keep in mind that number is merely dozens, not hundreds or thousands - are working with tokenized funds, some are indeed working directly with the individual underlying products.

Securities Lending and Collateral Mobility

Not everything ‘tokenized’ will be for investment purposes. One of the key filters in one’s depth when it comes to tokenization is that right there - moving beyond products and into the underlying systems. Stopping at the public-facing product level is like assuming the visible chunk of an iceberg is the entire iceberg.

Much of the current and future value in digitized and tokenized assets systems from the mobility that the technology process enables. This asset mobility is what unlocks the liquidity, the instantaneous settlement, and the portability across decentralized finance (DeFi) as many enthusiasts and professionals alike tout. STA has covered collateral management use-cases in previous reports, and those one-off projects or platforms have gained steam in the time since. Collateral management as a whole can take on multiple forms in this context, which examples like:

- Treasury management

- Repurchase agreements (repos)

- Securities Lending (SecLending)

One of the beautiful facets of tokenization is that it’s product agnostic. Once assets are digitized and standardized on compatible rails (i.e. Ethereum, Hyperledger), they’re seen as equivalents within the underlying plumbing. That means a money market fund, a private equity fund Limited Partner (LP) interest, a Series A company’s common shares, treasury funds, and even precious metals may all be sent to and from parties on aligned digital rails when tokenized. This is something that’s never been afforded to the capital markets ecosystem in any truly efficient manner.

The future reality with tokenization is that a financial institution or a corporation may use its equity holdings, debt holdings, alternative holdings, cash holdings, and other asset classes within its typical treasury management operations - this is a major breakout relative to the typical usage of cash and cash equivalents.

Something that really stood out this past quarter as a theme that’ll continue to shape and bridge capital markets players is securities lending (SecLending) via blockchain. Equilend is a prime example of this through its 1Source distributed ledger technology (DLT) platform. Equilend currently processes $2.8 trillion in trades monthly on its legacy platform and services clients and partners like Bank of America, BlackRock, Credit Suisse, Goldman Sachs, JP Morgan, Morgan Stanley, and State Street.

To have these names eventually spillover and work off of a shared SecLending ledger in the efforts to move settlement time to t+1 at the longest (and t+0 in an ideal setting) to meet the SEC’s mandate by May 2024 would be tremendous for the underlying tokenization service providers and ecosystem. In fact, Equilend’s executive team sees DLT as the only method of achieving t+1 and t+0 settlement simply due to the inter-party reconciliation process that’s necessary in other databases and services; a shared ledger via DLT would only require a party to check the ledger, not check with or wait on another party’s information recall or verification.. Human interaction and timelines will not meet the real-time nature of this business, and certainly not at scale.

Equilend is not alone in this mission. Broadly speaking, we can apply what we’re seeing in securities lending to its cousin, the repo markets. The future that’s shaping up involves assets and securities of all kinds on compatible and interoperable digital rails that enable seamless swaps and transfers, all with much greater precision and control parameters than existing infrastructure allows. That’s what this technology overlay opens up. Given that, look at some recurring names in the collateral management side. JP Morgan and its Tokenized Collateral Network (TCN), of which the bank’s blockchain-based repo network is a heavy contributor, has amassed over $900 billion (now $1 billion per day) in transaction volume fully in-house. The bank even signed on with the SecLending FinTech Sharegain to improve its existing client offering to wealth managers and online broker participants across 30 markets. While Sharegain is not blockchain-based, the desire for lending revenue is front and center, and that’s a tailwind for this facet of tokenization.

Similarly, the European platform HQLAx has been working with Goldman Sachs, JP Morgan, BNY Mellon, and major institutions solely for improved collateral and treasury management. Starting with simple products like treasury funds and money market funds, the firm noted that the technology could be rolled out to other securities and assets, thus further blurring the lines between repo efforts and SecLending activities as covered in a previous STA publication.

What’s more is that Equilend selected Digital Asset’s Daml language to underpin its DLT platform. This may provide Equilend with a user base and partner web of already 30 major institutions by way of Digital Asset’s Canton Network - including Broadridge who’s using Daml to support its $70 billion in daily (~$2.1 trillion monthly) Distributed Ledger Repo (DLR) transactions.

Digital Asset’s Canton Network

As one of Digital Asset’s most immense developments to date, Canton Network includes organizations like Goldman Sachs, Broadridge, S&P Global, BNP Paribas, Cboe, DRW, Moody’s, Deloitte, and roughly 30 others acting as node operators. This enables interoperability across members and initiatives in a fully-institutional network, which achieves a few things.

First, institutions can actually participate in inter-party activities. While the blockchain crowd loves the concept of democratized access and investing or working right alongside institutions, that’s not actually a reality yet. The reasoning is simple: many mandates and regulatory guidelines, or even in-house limitations, require retail and institutional capital and activities to remain separated. If a participant is accepted and allowed in Canton Network, it can be assumed that they are up to institutional caliber and/or has some qualified purpose of being there. It should also be noted that not every institution has to work with the other. In fact, Deloitte’s role is solely to offer Canton-specific services and skills, rather than to partner or affiliate with any of the other members.

That brings us to the next key point. Although Canton Network is operated on Digital Asset’s private blockchain solutions and channels, the fact that there are 30+ participants as node operators means the power and the responsibilities are dispersed across over all of its 30+ members. The network shifts from a singular point of control and failure to a distributed network (which is more fitting for the technology’s narrative). As firms and institutions join Canton and expand the network, it will presumably continue to disperse power and control across those members, thus creating even more widespread distribution. The word “decentralization” may not quite be the word here, considering the underlying solutions run through Digital Asset, although “distributed” works well as decision-making and maintenance runs through the network members themselves. Canton Network, therefore, plays more into the distributed ledger thesis of sharing controls across contributors albeit on a private network and secure network, which is an excellent blend for institutional players to get comfortable with.

Lastly, Canton Network is lowering barriers between institutions bilaterally and among institutions as a whole to cross-collaborate on initiatives, which as the industry has seen from numerous other programs (Broadridge DLR, JP Morgan Onyx, Swift), is the route to accelerated adoption. Whether that’s the ability to work on specific repo programs, improve asset swaps and contracts moving from Delivery v. Payment (DvP) to Delivery v. Delivery (DvD), or even to co-create complex products, the consortium approach presents a strong case.

In short, Digital Asset’s Canton Network provides institutions looking to enable tokenization from either a product, operational, or infrastructure level with security and confidence in knowing who the other members of the network are and their involvement levels, while also better achieving a degree of control distribution. It won’t be as decentralized or distributed as a true Layer 1 public blockchain, but this is a fantastic opportunity for institutions to get familiar and comfortable with the technology in a more controlled environment as a permissioned network.

WisdomTree Prime Moves from Beta Mode to Live Consumer App

WisdomTree Inc. and its $94 billion asset management arm brought one of of the most anticipated items to market towards the end of Q2 - WisdomTree Prime. WisdomTree Prime is a consumer app, available for download on the iOS App Store and Google Play Store, driven by blockchain technology to facilitate direct-to-retail investment products. The product launched with 9 digital funds in July 2023 to users in 21 states after WisdomTree received SEC approval for 10 funds between Q4 2022 and Q1 2023, and has since expanded to 11 additional states now totaling blockchain-based fund coverage to retail investors in 32 states. During the process, the asset manager acquired Securrency Transfers, the transfer agent arm of Securrency which supports all necessary transfer agent functionality alongside Stellar and Ethereum-based record-keeping and corporate actions. It has since been renamed WisdomTree Transfers Inc. and will be used in-house to facilitate WisdomTree Prime and future blockchain fund rollouts; it’s even possible that existing WisdomTree ETFs become replicated in digital fund form for greater exposure to investors and therefore greater revenue-generating opportunities via AUM fees. At scale, the digital transfer agent functionality should also be something that reduces fees for WisdomTree Inc. relative to legacy processes, and complements its FINRA broker-dealer approval for blockchain-enabled funds in November 2022. Additionally, blockchain settlement and record keeping will be instantaneous, which is powerful for both ordinary trades and future collateralization opportunities alike.

While the consumer app approach may not seem like a significant deal to institutional players, it’s worth keeping in mind that Millennial and Gen Z investors have a propensity for mobile investing over traditional brokerage accounts and interfaces. Even from Security Token Advisors discussions with money managers and financial institutions, there’s always the question of “how can we better service our retail clients?” Beyond investment access, WisdomTree Prime’s end goal seems to be a one-stop-shop for investment funds, digital assets, and cash, even making the value of these assets spendable and transferable in a consumer’s day-to-day, like at the grocery store or at the office. This functionality is not yet live nor the primary focus, but something to pay attention to as product suites continue to collide. See WisdomTree Prime in action from Security Token Market’s TokenizeThis Summit.

About the Author:

Peter Gaffney is the Head of Research at Security Token Advisors, an advisory group that constructs tokenization strategies for clients ranging from global asset managers to real estate investment groups to mortgage servicing platforms to private equity & venture capital firms and pre-IPO shares.

He leverages experiences at Global X ETFs and boutique private equity firms to bring the public and private markets under one roof via tokenization. Peter is the author of 'Blockchain Explained: Your Ultimate Guide to the Tokenization of Finance' and the 'State of Security Tokens' series.

LinkedIn: https://www.linkedin.com/in/peter-gaffney/

Twitter: https://twitter.com/pgaff_digital